Chapter 3

Quantified Insights

Can superior design enhance sales performance?

By Marie Hickey, Director of Retail Research, Savills

Experience has become a cornerstone of evolving retail strategy for brands and retail destinations, driven by shifting consumer expectations and changing spending patterns. These dynamics have been further intensified by global headwinds affecting both the luxury segment and discretionary retail spending more broadly.

This evolution is clearly visible in the growing incorporation of experience-led components within retail spaces — from cafés and restaurants to, in the case of luxury brands, purpose-built VIP hospitality areas. Leading players are even expanding beyond traditional retail into experience-focused sectors. A notable example is LVMH’s acquisition and strategic development of the Belmond Hotel group, reflecting a broader move to deepen brand engagement through lifestyle and hospitality.

Castello di Casole, Italy, Exterior – Photographer: Daniele Ragazzini; Source: LVMH Belmond via Belmond Media Library (2021).

But experience is more than just offering a coffee. Best-in-class retailers have long understood the importance of the physical environment in shaping consumer behaviour. Elements such as striking architecture, thoughtful store design and layout, exceptional customer service, high-quality amenities, and a differentiated product offer all contribute to creating a compelling retail experience.

When well executed, experience-led environments generate measurable results: increased visitor numbers, elevated social media engagement, and a “buzz” around the destination. Yet the critical question remains: can experience-oriented design directly enhance retail sales performance, and which design elements deliver the greatest returns?

This question is increasingly relevant for owners and investors. Delivering best-in-class retail destinations typically requires higher upfront investment. At a time when both top-line and bottom-line performance is under pressure, identifying which design strategies yield the strongest commercial outcomes is more important than ever.

Exemplar, best in class, case studies delivered a 70 percent outperformance in sales densities.

Isolating the impact of design on retail sales performance is notoriously difficult. Measuring “good design” is inherently subjective, and a host of external variables — geography, micro-location, operational management, and broader macroeconomic conditions — introduce considerable noise that makes it challenging to draw direct causal links between design quality and retail outcomes.

Despite these statistical complexities, our analysis suggests a strong directional relationship between high-quality design and retail sales performance. By benchmarking 23 of the world’s most prominent retail destinations based on expert assessments of design quality — across architecture, interior design, experience design & retail strategy — and comparing these scores with sales density data, a relatively high positive statistical correlation was identified between design quality and sales performance (based on correlation coefficient analysis).

Notably, destinations that achieved an aggregated design score above 75 percent of the total possible score — classified as “best in class” — recorded an average sales density of approximately $15,400 per sqm, which is 70 percent higher than the average across all case studies. When isolating turnovers to retail space only, this figure increased to $17,000 per sqm. In contrast, retail environments with design scores between 50 percent and 74 percent — considered good but not exemplar — delivered an average sales density of $6,800 per sqm, representing a 56 percent drop compared to their best-in-class peers.

Comparing average sales density per sqm across ‘architecture,’ ‘interior architecture,’ and ‘experience design & retail strategy’ dimensions.

Source: Savills Research, Sybarite

Crucially, the highest sales densities were found in environments that performed strongly across all design pillars: architecture, interior architecture, and experience design & retail strategy. This reinforces the importance of a holistic approach to retail design.

However, across the various design pillars assessed, interior architecture emerged as the strongest driver of outperformance with the strongest positive correlation to sales densities, followed closely by experience design & retail strategy.

The design elements that deliver.

Among all the design pillars evaluated, interior architecture stands out as having the greatest potential to influence consumer spending. Case studies that scored highest in interior architectural quality recorded average sales densities of $18,300 per sqm — 102 percent higher than the all case study average.

Shows the percentage uplift in sales density for best-in-class retail destinations compared with above-average destinations across six key criteria in the ‘experience design & retail strategy’ category — social sharing moments, culture & lifestyle, flexible spaces, brand curation, F&B curation, and digital technology.

Source: Savills Research, Sybarite

The strongest performers were those with a broad application of high-quality interior architectural elements, from seamless indoor-outdoor flow to ceiling treatments and intuitive wayfinding. However, “sense of place” — defined as the ability of interior design to reflect a unified identity, meaning, and emotional resonance — showed one of the strongest positive correlations with sales density of any single design element across all three pillars, delivering sales densities 76 percent higher than those case studies deemed as “above average.”

This reinforces the commercial value of creating spaces where people feel connected, inspired, which can be ultimately reflected in spend performance.

While other interior architectural components did not reach the same correlation strength as sense of place, they still demonstrated a positive influence on sales performance. Wayfinding for example, was linked to an 86 percent uplift in sales densities against above average case studies.

The experiential edge: social sharing opportunities and curated F&B.

Shows the percentage uplift in sales density for best-in-class retail destinations compared with above-average destinations across seven key criteria in the ‘interior architecture’ category — communication of sense of place, ceiling design & presentation, storefront design, lighting design, wayfinding, integration of nature and flow between indoor-outdoor.

Source: Savills Research, Sybarite

Within the experience design & retail strategy pillar, two components also showed a strong relationship with sales performance: design that delivered a variety of social sharing moments and secondly, the curation of food & beverage (F&B) experiences.

While social isolation linked to digital connectivity is prevalent in the thinking of younger consumers, creating physical environments that offer shareable, socially rich moments have the potential to deliver stronger commercial returns. Schemes that scored highest on the variety of social sharing moments delivered sales densities 121 percent higher than those considered merely above average. Similarly, those with best-in-class F&B curation outperformed above-average peers by 129 percent, underscoring the importance of integrating high-quality, experience-led hospitality into retail destinations.

What does this mean for owners and investors?

By Marie Hickey, Director of Retail Research, Savills

The most successful retailers, brands, and retail destinations already recognise the strategic value of design in shaping customer experience. This, in turn, drives deeper customer engagement, loyalty, and ultimately top-line performance. The acceleration of investment into physical retail — particularly in the post-pandemic era — demonstrates that leading operators are not only aware of shifting consumer preferences (especially among younger, digitally native demographics), but are actively capitalising on the renewed appetite for high-quality physical retail experiences.

For retailers, there are also clear margin advantages in driving a greater share of sales through physical stores, including increased basket size, lower return rates, and greater brand engagement. However, what this analysis aims to highlight is the potential scale of top-line uplift that can be unlocked through best-in-class design.

This study provides retailers, brands, and retail destinations with a more systematic and comparative perspective.

While it’s important to view design investment through the lens of return on investment (ROI), the findings argue for moving beyond a singular focus of financial metrics. Instead, ROI, design quality, and consumer experience should be reframed as an expanded inter-connected unit of measurement.

Delivering exceptional, experience-led environments that delight consumers requires continuous management, ongoing capital expenditure, and long-term planning to ensure the offer evolves without losing its quality. These data driven insights highlight the need for retailers, landlords and investors to broaden their success metrics when it comes to retail & leisure orientated destinations. When ROI, design, and experience are treated as complementary tools, invested parties have the opportunity to not only improve sales performance but also strengthen customer connection and loyalty — laying the foundation for more sustainable, long-term growth.

In this context, understanding the top-line potential of design and its read through to experience is just the first step. For owners and investors, it lays the foundation for more informed decision-making around capital deployment, asset repositioning, and long-term value creation.

The opportunity lies not just in creating standout destinations — but in aligning design quality with operational efficiency, to deliver retail experiences of the future that are both compelling and commercially resilient.

Methodology

By Marie Hickey, Director of Retail Research, Savills

The case studies comprised 23 of the most renowned department stores and shopping centres across North America, Europe, the Middle East, and Asia Pacific. These included iconic locations such as Harrods (London), Samaritaine (Paris), Mall of the Emirates (Dubai), and Ginza 6 (Tokyo).

- Case Study Name

- Tailoo Li Sanlitun

- Category

- Shopping Malls

- City

- Beijing

- Case Study Name

- SKP-S

- Category

- Department Stores

- City

- Multi-City

- Case Study Name

- Lane Crawford

- Category

- Department Stores

- City

- Hong Kong

- Case Study Name

- Hyundai

- Category

- Department Stores

- City

- Seoul

- Case Study Name

- Ginza 6

- Category

- Shopping Malls

- City

- Tokyo

- Case Study Name

- David Jones

- Category

- Department Stores

- City

- Melbourne

- Case Study Name

- KaDeWe

- Category

- Department Stores

- City

- Berlin

- Case Study Name

- Selfridges

- Category

- Department Stores

- City

- London

- Case Study Name

- Harrods

- Category

- Department Stores

- City

- London

- Case Study Name

- Harvey Nichols

- Category

- Department Stores

- City

- London

- Case Study Name

- Steen & Strøm

- Category

- Department Stores

- City

- Oslo

- Case Study Name

- Le Bon Marché

- Category

- Department Stores

- City

- Paris

- Case Study Name

- Samaritaine

- Category

- Department Stores

- City

- Paris

- Case Study Name

- Printemps

- Category

- Department Stores

- City

- Paris

- Case Study Name

- La Rinascente

- Category

- Department Stores

- City

- Milan

- Case Study Name

- The Grove

- Category

- Shopping Malls

- City

- Los Angeles

- Case Study Name

- Bloomingdales

- Category

- Department Stores

- City

- New York

- Case Study Name

- Saks Fifth Avenue

- Category

- Department Stores

- City

- New York

- Case Study Name

- Nordstrom

- Category

- Department Stores

- City

- New York

- Case Study Name

- Holt Renfrew

- Category

- Department Stores

- City

- Toronto

- Case Study Name

- Yorkdale

- Category

- Shopping Malls

- City

- Toronto

- Case Study Name

- Dubai Mall

- Category

- Shopping Malls

- City

- Dubai

- Case Study Name

- Mall of the EMIRATES

- Category

- Shopping Malls

- City

- Dubai

Selection Criteria

Locations were selected based on established global rankings of top-performing retail destinations and were validated through local market expertise from Sybarite and Savills.

Sales Performance

For each case study, 2024 in-store sales turnover data was either obtained directly or modelled based on historical performance. This data was used to calculate sales density figures by dividing turnover by both total scheme footprint and total retail (sales) floorspace.

Design Evaluation

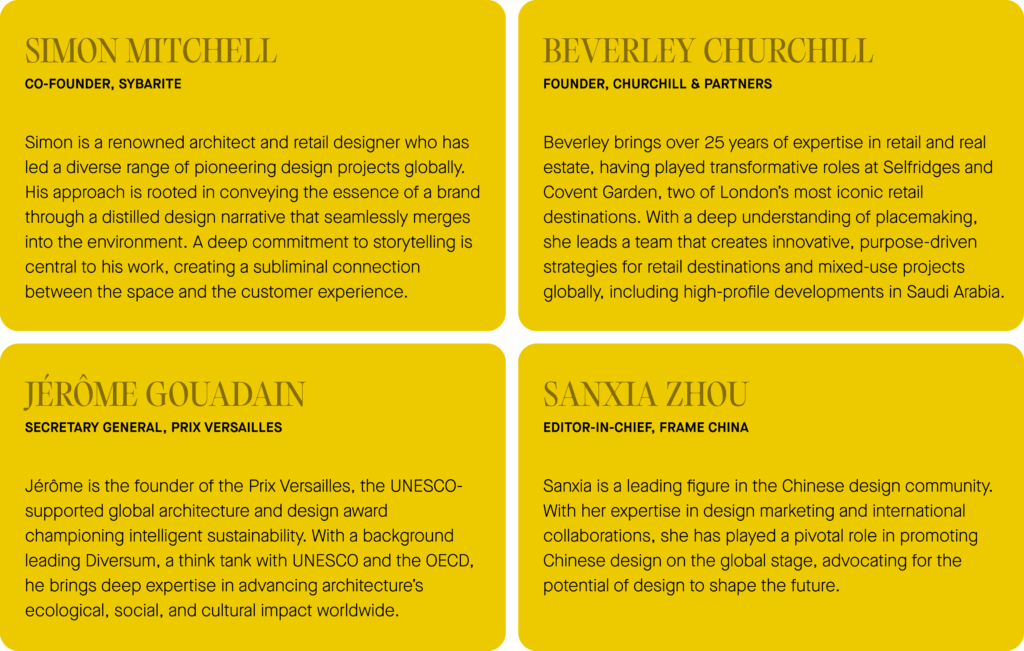

Design performance was assessed through a structured survey administered to a curated panel of expert reviewers from retail design, retail strategy, design media and architectural recognition bodies. The panel of experts include:

Each expert independently and anonymously scored case study schemes across 14 design attributes (detailed in the table below), grouped into three key pillars:

-

Architecture

-

Interior architecture

-

Experience design & retail strategy

Each attribute was rated on a 1 to 5 scale, with 5 representing excellence. Pillar scores were aggregated, and each case study’s score was expressed as a percentage of the total available score.

Benchmarking Criteria

Based on design scores:

- Best-in-class: ≥ 75 percent of the total available score

- Above average: 50–74 percent

Further detail on scoring attributes and panel questions can be found below: